| BRAZIL |

|

|

Formal

name in Portuguese:Republica Federativa do Brasil

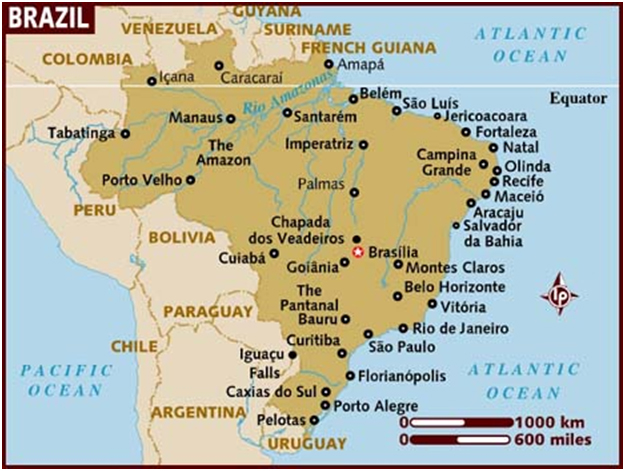

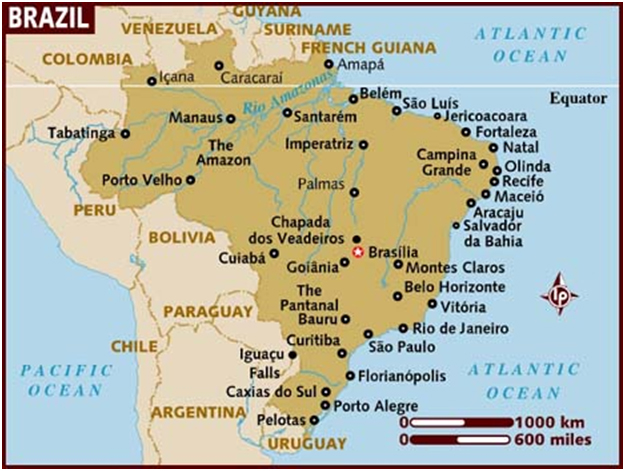

Capital: Brasilia

Head of Goverment: President Dilma ROUSSEF

Took office: 1 January 2011

Due to step down: 5 October 2014

Languages: Portuguese

Population: 201 millions (2013 est.)

Labour force: 107.1 million (2012 est.)

Surface area: 8,514,872

km2

GDP: US$2.362 trillion (2012 est.)

GDP per Capital: US$12,000 (2012 est.)

GDP Growth Rate:

1.3% (2012 est.)

Inflation: 5.5% (2012 est.)

Main economic sectors:

Services, Industry, Agriculture

Main export commodities: transport equipment, iron ore, soybeans, footwear, coffee, autos

Value of Exports :

US$242 billion (2012 est.)

Main trade partners: US,

Argentina, China

Largest companies (take from top 500 ranking):

PETROBRAS, VALE, PETROBRAS DISTRIBUIDORA,

GERDAU, ODEBRECHI

Top business schools: FGV-ESAP,

FIA U. SAO PAULO, COPPEAD, FGV-EBAPE, BSP

Poverty (% living on <US$2/day): 21.4%

Education (% of young people in higher education):

30%

Human development index (2012):

0.730

Energy consumption (Quadrillion Btu): 11.657

Energy production (Quadrillion Btu):9.926

Sources of energy: oil

(49%), natural gas (7%), hydropower (36%)

(Source: CIA, The World Factbook)

|

|

|

|

| COUNTRY

BRIEF |

Characterized by large and well-developed agricultural, mining, manufacturing, and service sectors, Brazil's economy outweighs that of all other South American countries, and Brazil is expanding its presence in world markets. Since 2003, Brazil has steadily improved its macroeconomic stability, building up foreign reserves, and reducing its debt profile by shifting its debt burden toward real denominated and domestically held instruments. In 2008, Brazil became a net external creditor and two ratings agencies awarded investment grade status to its debt. After strong growth in 2007 and 2008, the onset of the global financial crisis hit Brazil in 2008. Brazil experienced two quarters of recession, as global demand for Brazil's commodity-based exports dwindled and external credit dried up. However, Brazil was one of the first emerging markets to begin a recovery. In 2010, consumer and investor confidence revived and GDP growth reached 7.5%, the highest growth rate in the past 25 years. Rising inflation led the authorities to take measures to cool the economy; these actions and the deteriorating international economic situation slowed growth to 2.7% in 2011, and 1.3% in 2012. Unemployment is at historic lows and Brazil's traditionally high level of income inequality has declined for each of the last 14 years. Brazil's historically high interest rates have made it an attractive destination for foreign investors. Large capital inflows over the past several years have contributed to the appreciation of the currency, hurting the competitiveness of Brazilian manufacturing and leading the government to intervene in foreign exchange markets and raise taxes on some foreign capital inflows. President Dilma ROUSSEFF has retained the previous administration's commitment to inflation targeting by the central bank, a floating exchange rate, and fiscal restraint. In an effort to boost growth, in 2012 the administration implemented a somewhat more expansionary monetary policy that has failed to stimulate much growth.

(Source: CIA, The World Factbook) |

|